is cryptocurrency safe

Is cryptocurrency safe

A key property of gold is that it is almost impossible to destroy (durable) but can be melted down into smaller units (divisible), which are relatively easy to transport (portable) and when divided, each unit has identical properties (fungible).< https://otceed.com/ed-seykota-ideas-thoughts-and-rules-of-a-legendary-trader/ /p>

Blockchains are distributed in that they are stored on the computers of every single participant in the network (peer-to-peer). This is in contrast to centralized organizations, which store their ledgers and code on centralized servers inaccessible to the public.

You must be dying to get started right away. And technically, you could. It’s that easy! But, like most things worth pursuing, trading is hard! It would take us a long time to talk about all that you need to keep in mind.

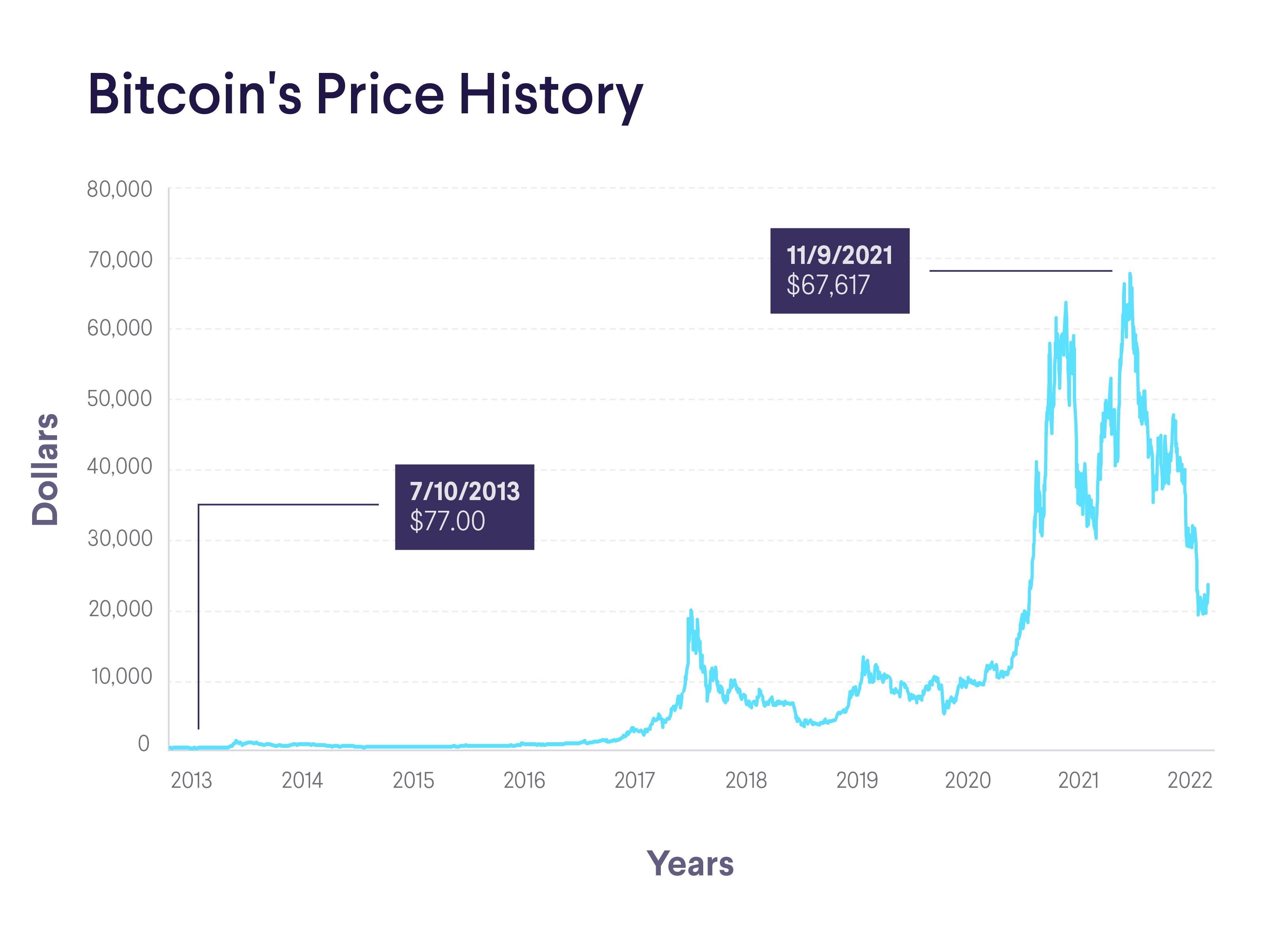

Cryptocurrency bitcoin price

Helaas is het minen van bitcoin verre van eenvoudig. Je hebt er een waanzinnige hoeveelheid elektriciteit voor nodig. (Om dit in verhouding te plaatsen, de blockchain verbruikt jaarlijks 68,13 terawattuur aan stroom — dat staat gelijk aan dat van Tsjechië, een land met 10,7 miljoen mensen. Een enkele transactie staat gelijk aan de elektriciteit dat een gemiddeld Amerikaans huishouden verbruikt in 20 dagen. Dit blijkt uit onderzoek door Digiconomist.)

The entire cryptocurrency market — now worth more than $2 trillion — is based on the idea realized by Bitcoin: money that can be sent and received by anyone, anywhere in the world without reliance on trusted intermediaries, such as banks and financial services companies.

What exactly are governments and nonprofits doing to reduce Bitcoin energy consumption? Earlier this year in the U.S., a congressional hearing was held on the topic where politicians and tech figures discussed the future of crypto mining in the U.S, specifically highlighting their concerns regarding fossil fuel consumption. Leaders also discussed the current debate surrounding the coal-to-crypto trend, particularly regarding the number of coal plants in New York and Pennsylvania that are in the process of being repurposed into mining farms.

The first chain to launch smart contracts was Ethereum. A smart contract enables multiple scripts to engage with each other using clearly defined rules, to execute on tasks which can become a coded form of a contract. They have revolutionized the digital asset space because they have enabled decentralized exchanges, decentralized finance, ICOs, IDOs and much more. A huge proportion of the value created and stored in cryptocurrency is enabled by smart contracts.

At present, miners are heavily reliant on renewable energy sources, with estimates suggesting that Bitcoin’s use of renewable energy may span anywhere from 40-75%. However, to this point, critics claim that increasing Bitcoin’s renewable energy usage will take away from solar sources powering other sectors and industries like hospitals, factories or homes. The Bitcoin mining community also attests that the expansion of mining can help lead to the construction of new solar and wind farms in the future.

Cryptocurrency tax

2. Import your historical transactions by connecting your accounts to the CoinLedger platform or uploading the CSV transaction history report from your exchange. Note, CoinLedger requires “read only” access to your exchange account. This type of access protects your funds and does not give CoinLedger any ability to move funds or transact on your behalf.

David Rodeck specializes in making insurance, investing, and financial planning understandable for readers. He has written for publications like AARP and Forbes Advisor, as well as major corporations like Fidelity and Prudential. Before writing full time, David was a financial advisor. That added a layer of expertise to his work that other writers cannot match.

If all of your crypto transactions occur on one exchange, then, gathering the information you need to report cryptocurrency on your tax return should be easy. If you have crypto transactions across several exchanges, crypto wallets or crypto credit cards, however, things may get more complicated. You’ll need to get a report from each place a transaction occurred or track the transactions yourself.

Compiling the information can be time-consuming work, especially if you’ve made many trades. But crypto-specific tax software that connects to your crypto exchange, compiles the information and generates IRS Form 8949 for you can make this task easier.

If you held your ETH for one year or less, the $600 profit would be taxed as a short-term capital gain. Short-term capital gains are taxed the same as regular income—and that means your adjusted gross income (AGI) determines the tax rate you pay.

Let’s say you bought $1,000 in Ethereum and then sold the coins later for $1,600. You’ll need to report that $600 capital gain on your taxes. The taxes you owe depend on the length of time you held your coins.